Is the Gerber Life Plan Real? Gerber Life Insurance offers many types of life insurance for people in all stages of life. The Grow‑Up® Plan is a whole life insurance policy for children that starts protecting your child early on and continues into adulthood, for financial protection that can last a lifetime.

Also, How do I get my money from Gerber grow up?

You can borrow from the cash value, as long as premiums are paid, by taking a policy loan. Policy loans are subject to 8% interest rate and may impact cash value and death benefit. You can also surrender the policy and receive the available cash value.

How much is Gerber Life? Term Life Plan

Flexible coverage options available from $100,000 to $300,000. Affordable coverage for as little as $15.42 a month for a 20-year, $100,000 Term Life policy. Applying is simple — just a few questions to answer. No medical exam needed in most cases.

Are Gerber college plans tax deductible?

“Despite the name, the Gerber College Savings Plan doesn’t offer state tax-deductible contributions or the ability to withdraw and spend funds on college expenses tax-free, both of which the 529 savings plan offers, and therefore isn’t a college plan at all,” Alan Moore, founder and certified financial planner at …

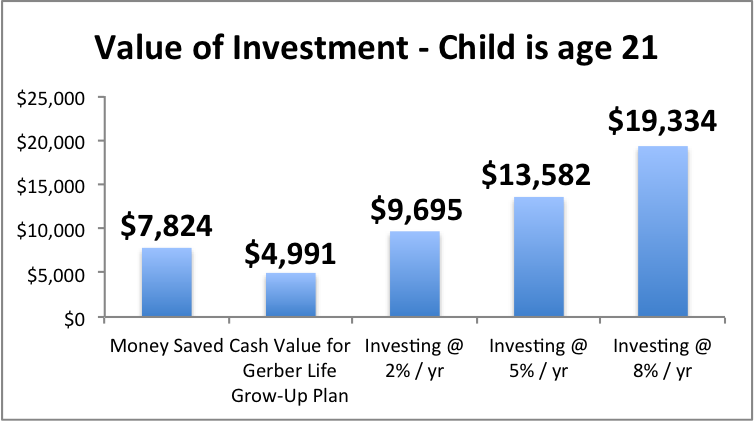

How do you determine the cash value of a Gerber Grow Up Plan?

Cash value works like this: each time you make a monthly premium payment for your Grow-Up® Plan, Gerber Life sets aside a small amount of money. Over time, this becomes the cash value of your policy. It represents how much your policy is worth at any given point in time.

How long is Gerber Life insurance Good For?

Term Life insurance is a popular choice for financially protecting families for only a specific period of time, known as a “term.” The Gerber Life Term Life Plan, for example, can last for 10, 20 or 30 years, depending on what you select.

How do I cancel my Gerber Grow Up Plan?

To cancel your Gerber Life Insurance policy:

- Call customer service on 800-704-3331.

- Ask to speak with a representative.

- Provide them with your policy number and customer details.

- Request cancellation of your life insurance policy.

- You will receive a confirmation letter or email.

What is difference between whole life and term life insurance?

Two of the most common types of life insurance are term life vs. whole life. Both term life and whole life provide a death benefit for the beneficiaries you choose, but whole life is a type of permanent policy with a savings component, while term life is only in force for the period of time that you choose.

Does Gerber cover adults?

Whole Life

Gerber Life offers $50,000 to $300,000 of coverage, and adults between 18 and 70 can apply. Your policy can gain cash value over time, and you can borrow against the policy to cover unexpected expenses or to supplement your retirement income. Medical exams are usually not necessary.

Can I get life insurance on my 28 year old son?

Life Insurance for my Adult Child

A parent can carry a life insurance policy on their adult child. This is because you have an insurable interest in your child. … If your child is over the age of 18, they have to consent to allow you take out the policy on their life.

Can I cancel a life insurance policy My parents have on me?

The parent or grandparent sometimes will simply opt to surrender (terminate) the policy and receive the surrender value in cash. If your parent or grandparent owns a policy on you and you prefer to be the owner, you can offer to buy it from them. Offer what the policy is worth in exchange for transferring ownership.

Is Gerber a 529 plan?

In terms of risk, the rate of return on 529 Plans is tied to the stock market. … The Gerber Life College Plan offers guaranteed growth that isn’t impacted by the stock market.

How do I cancel my Gerber Life subscription?

To cancel your Gerber Life Insurance policy:

- Call customer service on 800-704-3331.

- Ask to speak with a representative.

- Provide them with your policy number and customer details.

- Request cancellation of your life insurance policy.

- You will receive a confirmation letter or email.

How can I save my future baby?

- Create a Children’s Savings Account.

- Open a Custodial Account.

- Leverage a 529 College Savings or Prepaid Tuition Plan.

- Use Your Roth IRA.

- Open a Health Savings Account.

- Set Aside Money in a Trust Fund.

- Teach Your Kids the Value of Saving Money.

Do Gerber babies get paid?

Importantly, San Mateo, CA has a moderately active Gerber Baby job market with only a few companies currently hiring for this type of role.

…

What are Top 10 Highest Paying Cities for Gerber Baby Jobs.

| City | Richmond, CA |

|---|---|

| Annual Salary | $84,736 |

| Monthly Pay | $7,061 |

| Weekly Pay | $1,630 |

| Hourly Wage | $40.74 |

Does Gerber Life Insurance Pay Dividends?

Gerber Life is no longer part of the Gerber Products Company. The company offers whole, term, accidental, and guaranteed issue policies. It offers a 30-day money-back guarantee on most policies.

…

Competition.

| Gerber Life Insurance | New York Life | |

|---|---|---|

| Dividends for 2021 | Not applicable | $1.8 billion |

How much cash value does Gerber Grow Up Plan?

If, however, you live longer than the period of coverage, you receive the policy’s face value which, at that point, would equal its cash value. Gerber College Plans come with face values between $10,000 to $150,000, and are priced according to your health, since you’re the one who’s insured for the length of coverage.

Can I get money back if I cancel my life insurance?

If you cancel or outlive your term life insurance policy, you don’t get money back. However, if you have a “return of premium” rider and you outlive the policy, premiums will be refunded.

What happens when you cancel a Gerber Life insurance policy?

If you decide to cancel the policy, you’ll receive the accumulated cash value that has built up over time, minus any outstanding debt against the policy. … If you’re temporarily unable to pay your monthly premiums, Gerber Life may be able to pay them for you by using your policy’s available cash value.

How much life insurance do you get for 9.95 a month?

For a 68 year-old-male, 1 unit at $9.95 a month qualifies you for a total of $792 in life insurance coverage.

Which one is better whole life or term life?

Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—if you can keep up with the premium payments. Whole life premiums can cost five to 15 times more than term policies with the same death benefit, so they may not be an option for budget-conscious consumers.

Do you get your money back at the end of a term life insurance?

If you outlive the policy, you get back exactly what you paid in, with no interest. The money back is not taxable, as it’s simply a return of payments you made. With a regular term life insurance policy, if you are still living when the policy expires, you get nothing back.

Leave a Review