How does the Gerber plan work? The Gerber Life College Plan is an individual endowment policy that provides adult life insurance coverage for parents for a specified period of time chosen by you – between 10 and 20 years. At the end of that term, you’ll receive a guaranteed payout for your child.

Also, How do I get my money from Gerber grow up?

You can borrow from the cash value, as long as premiums are paid, by taking a policy loan. Policy loans are subject to 8% interest rate and may impact cash value and death benefit. You can also surrender the policy and receive the available cash value.

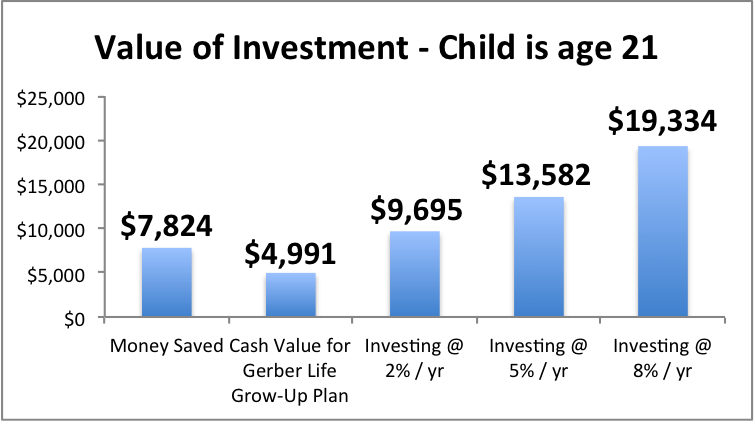

What exactly is the Gerber Grow Up Plan? The Grow-Up® Plan is a children’s whole life insurance policy that offers lifelong coverage for the insured child as long as premiums are paid. … This makes the Gerber Life Grow-Up® Plan a great and meaningful gift that can be bought by a child’s parent, grandparent or permanent, legal guardian.

Are Gerber college plans tax deductible?

“Despite the name, the Gerber College Savings Plan doesn’t offer state tax-deductible contributions or the ability to withdraw and spend funds on college expenses tax-free, both of which the 529 savings plan offers, and therefore isn’t a college plan at all,” Alan Moore, founder and certified financial planner at …

How do I know if I have Gerber Life insurance?

Your Application or Policy Number is in the approval email and/or premium notice. Need help finding your number? Just call 800-704-2180.

How long is Gerber Life insurance Good For?

Term Life insurance is a popular choice for financially protecting families for only a specific period of time, known as a “term.” The Gerber Life Term Life Plan, for example, can last for 10, 20 or 30 years, depending on what you select.

How do I cancel my Gerber Grow Up Plan?

To cancel your Gerber Life Insurance policy:

- Call customer service on 800-704-3331.

- Ask to speak with a representative.

- Provide them with your policy number and customer details.

- Request cancellation of your life insurance policy.

- You will receive a confirmation letter or email.

Which is best policy for child?

Best Child Insurance Plans in India

| Child Plans | Entry Age | Maximum Maturity Age |

|---|---|---|

| Exide Life Mera Aashirvad Plan | 21-50 years | 65 years |

| Future Generali Assured Education Plan (Child Education Plan) | 21-50 years | 67 years |

| HDFC SL YoungStar Super Premium | 18-65 years | 75 years |

| ICICI Pru Smart kid Assure plan | 20-54 years | 64 years |

• Jul 29, 2021

Can I get money back if I cancel my life insurance?

If you cancel or outlive your term life insurance policy, you don’t get money back. However, if you have a “return of premium” rider and you outlive the policy, premiums will be refunded.

What is difference between whole life and term life insurance?

Two of the most common types of life insurance are term life vs. whole life. Both term life and whole life provide a death benefit for the beneficiaries you choose, but whole life is a type of permanent policy with a savings component, while term life is only in force for the period of time that you choose.

Is Gerber a 529 plan?

In terms of risk, the rate of return on 529 Plans is tied to the stock market. … The Gerber Life College Plan offers guaranteed growth that isn’t impacted by the stock market.

How do I cancel my Gerber Life subscription?

To cancel your Gerber Life Insurance policy:

- Call customer service on 800-704-3331.

- Ask to speak with a representative.

- Provide them with your policy number and customer details.

- Request cancellation of your life insurance policy.

- You will receive a confirmation letter or email.

How can I save my future baby?

- Create a Children’s Savings Account.

- Open a Custodial Account.

- Leverage a 529 College Savings or Prepaid Tuition Plan.

- Use Your Roth IRA.

- Open a Health Savings Account.

- Set Aside Money in a Trust Fund.

- Teach Your Kids the Value of Saving Money.

How long does Gerber Life take to pay out?

The Gerber Life College Plan is an individual endowment policy with an adult life insurance benefit that provides a guaranteed payout of $10,000 up to $150,000 when it matures in 10 to 20 years.

Where is Gerber Life located?

Gerber Life is headquartered in White Plains, New York, and has an operation center in Fremont, Michigan.

How do I cancel my Gerber?

To cancel your Gerber Life Insurance policy:

- Call customer service on 800-704-3331.

- Ask to speak with a representative.

- Provide them with your policy number and customer details.

- Request cancellation of your life insurance policy.

- You will receive a confirmation letter or email.

What happens when you cancel a Gerber Life insurance policy?

If you decide to cancel the policy, you’ll receive the accumulated cash value that has built up over time, minus any outstanding debt against the policy. … If you’re temporarily unable to pay your monthly premiums, Gerber Life may be able to pay them for you by using your policy’s available cash value.

Does Gerber cover adults?

Whole Life

Gerber Life offers $50,000 to $300,000 of coverage, and adults between 18 and 70 can apply. Your policy can gain cash value over time, and you can borrow against the policy to cover unexpected expenses or to supplement your retirement income. Medical exams are usually not necessary.

Does Gerber Life insurance Pay Dividends?

Your insurance company will invest the money and whenever you pass, your beneficiary will receive the full amount of the policy. You may also receive dividends from your investment in a whole life insurance policy. Gerber Life has a variety of life insurance plans to fit your family’s needs.

How much cash value does Gerber Grow Up Plan?

If, however, you live longer than the period of coverage, you receive the policy’s face value which, at that point, would equal its cash value. Gerber College Plans come with face values between $10,000 to $150,000, and are priced according to your health, since you’re the one who’s insured for the length of coverage.

Which is the best plan for girl child?

Comparison of SSY with Children Mutual Funds

| Factor | Sukanya Samriddhi Yojana |

|---|---|

| Returns | Fixed (It is currently 7.6% per annum) |

| Number of accounts | Maximum of two accounts for a family with two or more daughters |

| Risk | Risk-free as sovereign guarantees back the scheme |

| Lock-in period | 21 years from the date of opening the account |

• Oct 6, 2021

Can I just insure my child?

Child-only health insurance does exactly what you’d think it would do: it covers children–and only children. That’s opposed to most other health plans, which focus on covering just adults, or adults and their dependent children.

How do I choose an insurance plan for my child?

How to choose the Best Child Education Plan?

- Invest in plans that offer premium waiver benefit. …

- If you have the risk appetite then go for equity-linked plans. …

- If you do not have the risk appetite, go for simple endowment plans.

Leave a Review