Does Gerber cover adults? Whole Life

Gerber Life offers $50,000 to $300,000 of coverage, and adults between 18 and 70 can apply. Your policy can gain cash value over time, and you can borrow against the policy to cover unexpected expenses or to supplement your retirement income. Medical exams are usually not necessary.

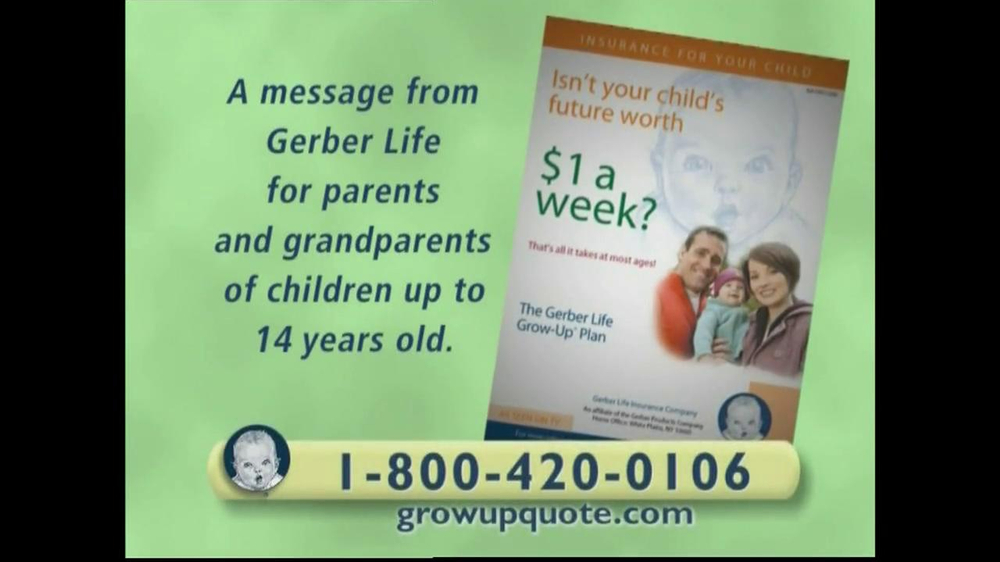

Also, Is the Gerber Life Plan Real?

Gerber Life Insurance offers many types of life insurance for people in all stages of life. The Grow‑Up® Plan is a whole life insurance policy for children that starts protecting your child early on and continues into adulthood, for financial protection that can last a lifetime.

How do I get my money from Gerber grow up? You can borrow from the cash value, as long as premiums are paid, by taking a policy loan. Policy loans are subject to 8% interest rate and may impact cash value and death benefit. You can also surrender the policy and receive the available cash value.

Can I buy a life insurance policy for a family member?

You can buy a life insurance policy on a family member, romantic partner or business partner, for instance. … And, often, the person has to undergo a life insurance medical exam as part of the application process.

Can I get life insurance on my 28 year old son?

Life Insurance for my Adult Child

A parent can carry a life insurance policy on their adult child. This is because you have an insurable interest in your child. … If your child is over the age of 18, they have to consent to allow you take out the policy on their life.

How much is Gerber life?

Term Life Plan

Flexible coverage options available from $100,000 to $300,000. Affordable coverage for as little as $15.42 a month for a 20-year, $100,000 Term Life policy. Applying is simple — just a few questions to answer. No medical exam needed in most cases.

Are Gerber college plans tax deductible?

“Despite the name, the Gerber College Savings Plan doesn’t offer state tax-deductible contributions or the ability to withdraw and spend funds on college expenses tax-free, both of which the 529 savings plan offers, and therefore isn’t a college plan at all,” Alan Moore, founder and certified financial planner at …

How long is Gerber Life insurance Good For?

Term Life insurance is a popular choice for financially protecting families for only a specific period of time, known as a “term.” The Gerber Life Term Life Plan, for example, can last for 10, 20 or 30 years, depending on what you select.

How do I cancel my Gerber Grow Up Plan?

To cancel your Gerber Life Insurance policy:

- Call customer service on 800-704-3331.

- Ask to speak with a representative.

- Provide them with your policy number and customer details.

- Request cancellation of your life insurance policy.

- You will receive a confirmation letter or email.

What is difference between whole life and term life insurance?

Two of the most common types of life insurance are term life vs. whole life. Both term life and whole life provide a death benefit for the beneficiaries you choose, but whole life is a type of permanent policy with a savings component, while term life is only in force for the period of time that you choose.

Can I get life insurance on my mother without her knowing?

When you’re getting life insurance, the person whose life will be insured is required to sign the application and give consent. … So the answer is no, you can’t get life insurance on someone without telling them, they must consent to it.

Can a daughter get life insurance on her father?

Yes, you can purchase life insurance for your parents to help cover the final expenses they leave behind. … In order to buy a policy on a parent, you will need their consent along with proof of insurable interest. The type of policy you buy will depend on their age, financial situation, and their overall health.

Can I put life insurance on my mom?

Yes, you can purchase life insurance on your parent. But, you must have their consent – either mom’s consent, or dad’s consent. Furthermore, you have to show insurable interest, meaning that you will suffer some kind of loss with the insured’s passing. Usually a financial loss.

What is better term or whole life?

Term life is “pure” insurance, whereas whole life adds a cash value component that you can tap during your lifetime. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—if you can keep up with the premium payments.

How much cash value does Gerber Grow Up Plan?

If, however, you live longer than the period of coverage, you receive the policy’s face value which, at that point, would equal its cash value. Gerber College Plans come with face values between $10,000 to $150,000, and are priced according to your health, since you’re the one who’s insured for the length of coverage.

Can I cancel a life insurance policy My parents have on me?

The parent or grandparent sometimes will simply opt to surrender (terminate) the policy and receive the surrender value in cash. If your parent or grandparent owns a policy on you and you prefer to be the owner, you can offer to buy it from them. Offer what the policy is worth in exchange for transferring ownership.

Is Gerber a 529 plan?

In terms of risk, the rate of return on 529 Plans is tied to the stock market. … The Gerber Life College Plan offers guaranteed growth that isn’t impacted by the stock market.

How do I cancel my Gerber Life subscription?

To cancel your Gerber Life Insurance policy:

- Call customer service on 800-704-3331.

- Ask to speak with a representative.

- Provide them with your policy number and customer details.

- Request cancellation of your life insurance policy.

- You will receive a confirmation letter or email.

How can I save my future baby?

- Create a Children’s Savings Account.

- Open a Custodial Account.

- Leverage a 529 College Savings or Prepaid Tuition Plan.

- Use Your Roth IRA.

- Open a Health Savings Account.

- Set Aside Money in a Trust Fund.

- Teach Your Kids the Value of Saving Money.

What is the Gerber Life Plan?

The Gerber Life College Plan is an individual endowment policy that provides adult life insurance coverage for parents for a specified period of time chosen by you – between 10 and 20 years. At the end of that term, you’ll receive a guaranteed payout for your child.

What is Gerber term life?

Gerber’s term life insurance provides between $25,000 to $150,000 of coverage and doesn’t require a medical exam if you’re under 50 or want a death benefit of up to $100,000. Term lengths can extend for 10,15, 20 or 30 years and, should your needs change, you can convert it to a whole life insurance policy.

How do you determine the cash value of a life insurance policy?

To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy.

Leave a Review