How can I get $600 from Chase? Chase Bank is offering new customers up to $600 to open a new Self-Directed Investing account.

…

- Open a J.P. Morgan Self-Directed Investing account.

- Within 45 days, fund your account with qualifying new money; $100,000 – $249,999 = $300 bonus, $250,000 = $600 bonus.

- Your bonus amount will be determined on day 45.

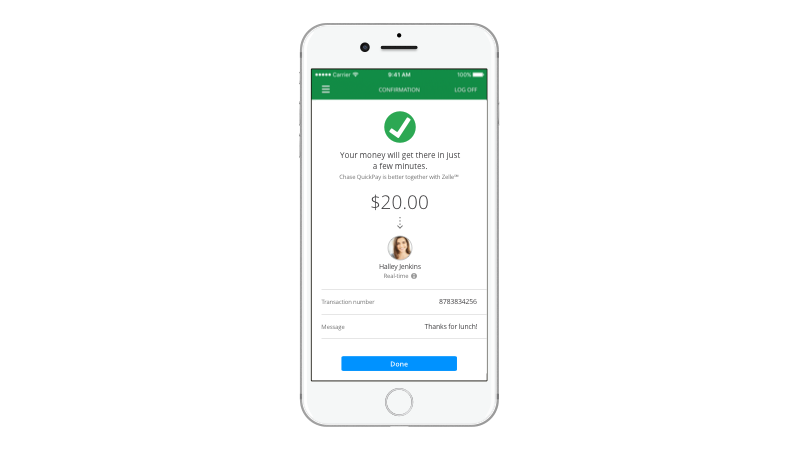

Also, Does Chase use Zelle?

Yes. Chase customers can use Zelle to send and receive money at no charge. Message and data rates may apply depending on your mobile service provider.

Does Chase really give you $200? Yes, Chase gives new checking customers a $200 bonus after a customer opens a Chase Total Checking account with a promotional coupon code, then completes a direct deposit within 90 days of opening the account. … Chase will automatically apply the $200 checking coupon code when you click “Open an account” online.

What banks pay you to open an account in 2021?

Top Bank Account Promotions for November 2021

- Citi Priority Account – Up to $1,500 Cash Bonus. …

- HSBC Premier Checking – $450 Welcome Offer. …

- Wells Fargo Everyday Checking – $200 Bonus. …

- Chase Total Checking® – $225 Bonus. …

- TD Bank Beyond Checking℠ – $300 Cash Bonus. …

- Aspiration Plus – $200 Bonus.

What is the minimum balance for Chase Total checking?

There is no minimum balance required for Chase checking accounts, but keeping a certain balance is one way to avoid a monthly fee on some accounts — for example, the $12 monthly fee for Chase Total Checking® is waived if you maintain a $1,500 balance at the beginning of each day.

Can I send $5000 through Zelle?

Generally speaking, Zelle limits its users to sending approximately $1,000 a week, or up to $5,000 a month. This varies from bank to bank, so make sure to check the sending limit of your bank.

Can Zelle refund money if scammed?

Quick-pay apps like Zelle don’t offer any of the fraud protections you get with credit cards. The Zelle user agreement says if you send someone money and it turns out to be a scammer, too bad. There are no refunds.

Who can receive Chase QuickPay?

With a Chase checking account, you can:

Request money and send payments almost anyone you know with a U.S. bank account and an email address or a U.S. mobile phone number. Send money to and receive money directly from people you know and trust.

Is chase a good bank?

Chase has a good basic checking account, and its sign-up bonuses earned it a place in NerdWallet’s Best-Of Awards for 2021. But Chase’s savings rates are generally low, and some fees are high and hard to avoid.

How much money do I need to open a Chase account?

Chase Total Checking is a basic checking account. The monthly service fee for a Total Checking account is $12, but there are ways that you can get that service fee waived. Total Checking requires a minimum deposit of $25 to open an account.

Why is Chase charging me a $12 service fee?

Chase Bank has recently implemented a $12 monthly “service fee” to checking accounts that do not receive a direct deposit of $500 or more. According to Chase, the direct deposits “must be an ACH credit, may include payroll, pension or government benefit payments, such as Social Security.”

Does Chase have any promotions?

Chase Freedom Unlimited Credit Card Promotion – $200 Cashback. When you apply for the Chase Freedom Unlimited credit card through Millennial Money you can get $200 cashback. Once you get your card you have to spend $500 on purchases within three months and you will receive a $200 cash back bonus.

How can u get free money?

Quick Guide to Get Free Money:

- Refinance your student loans.

- Take online surveys.

- Lower your mortgage payment.

- Consolidate your debt.

- Get rebates from local retailers.

- $5 signup bonus with Inbox Dollars.

- Rack up some Swagbucks.

- $10 signup bonus with Ebates.

Why did Chase deny me a checking account?

The most likely reason to be denied an account is that you’ve got an outstanding debt with a bank – often because of unpaid bank fees. … If you owe a bank money according to your ChexSystems report, you’ll need to either negotiate with the bank you owe to pay off the debt, or dispute the report as inaccurate.

How much will chase let you overdraft at ATM?

If we pay an item, we’ll charge you a $34 Insufficient Funds Fee per item during our nightly processing beginning with the first item that overdraws your account balance by more than $50 (maximum of 3 fees per business day, up to $102).

How can I waive Chase monthly fee?

Students pay a Chase monthly checking account fee of $6. Total Checking account fees can be waived if you have a daily balance of $1500 or more. You can also get the monthly fee waived if you have more than $500 in Direct Deposits each month into the account.

Does BBVA use Zelle?

BBVA has partnered with Zelle. … You can find out when Zelle will be available for you to use with your BBVA account on Zelle’s website, here. You will be able to use the service via your mobile banking app.

What company owns Zelle?

Who Owns Zelle? Zelle is a product of Early Warning Services, LLC, a fintech company owned by seven of America’s largest banks: Bank of America, BB&T (now Truist), Capital One, JPMorgan Chase, PNC Bank, U.S. Bank and Wells Fargo.

Is Zelle and Chase QuickPay the same?

Chase QuickPay® with Zelle® is now just Zelle

It’s still simple to send and receive money from almost anyone 1 in the U.S., Chase customer or not. Send and receive money in moments 1 , so no more waiting days or paying fees like other apps to access your money right away. … Learn more about Chase checking accounts.

Why is Zelle so bad?

The biggest drawback of Zelle is that it doesn’t offer fraud protection for authorized payments. In other words, if you purchase something online and use Zelle to pay for it, you have no recourse if you never receive the item you paid for.

Is it safe to Zelle strangers?

With Zelle®, you can send money from your account to someone else’s within minutes1. It’s a great way to pay friends, family, your coworkers and almost anyone else you trust, but it shouldn’t be used to pay strangers. … Money moves fast – directly into the enrolled recipient’s bank account.

Can someone hack your bank account Zelle?

Consumer advocates say scammers are exploiting Zelle because the app is connected automatically to millions of bank accounts. When victims open their mobile banking app, Zelle is right there, connected to their money. Bottom line, don’t answer a text or call even if it seems to be your bank.

Leave a Review